Going deeper into India’s Central Bank Digital Currency (CBDC)

Introduction

In the last article we understood the concept of Central Bank Digital Currency (CBDC) as digital version of a country’s physical currency having the same value as that of physical currency. In India, CBDC have be classified into two broad types viz. general purpose or retail (CBDC-R) and wholesale (CBDC-W). The retail CBDC would be potentially available for use by all viz. private sector, non-financial consumers and businesses while wholesale CBDC is designed for restricted access to select financial institutions. While Wholesale CBDC is intended for the settlement of interbank transfers and related wholesale transactions, Retail CBDC is an electronic version of cash primarily meant for retail transactions. This article explores more practical nuances of the e-RUPI.

Features

The below are the key features basis on which the NPCI / RBI have proposed to roll out e-RUPI:

- e-RUPI voucher is an end-to-end digital solution to sponsor benefits and services to beneficiaries. e-RUPI can be issued by the sponsor with the support of Issuer banks.

- e-RUPI is a one-time and multiple time use contactless, cashless voucher-based mode of payment that helps users redeem the voucher without card, digital payments app, or internet banking access.

- e-RUPI is a person-specific and even purpose-specific digital voucher, which means these vouchers can be used by person (to whom the voucher is been given) for specific purpose.

- Beneficiary receives e-RUPI voucher on the mobile phone in the form of SMS/QR code.

- Beneficiary can redeem the e-RUPI voucher at any merchant center which is enabled for e-RUPI acceptance.

Principles

Below are the principles based on e-RUPI shall operate:

- e-RUPI voucher can be created or revoked on the request of the Sponsor (Government/Private Entities)

- The cap on the amount for e-RUPI vouchers is INR 1,00,000/- per voucher for Government schemes only. For Private entities, the limit of e-RUPI voucher is at INR 10,000/- per voucher.

- The e-RUPI voucher is allowed to redeem for P2M (Person to Merchant) purchases only. It can be accepted on all UPI merchant acceptance points, or at specific locations as per designed scheme, while issuance of such instrument.

- Every voucher is “digitally validated” on the redemption.

- The voucher issuance format will be digital only for e.g., QR code, SMS string etc. The Issuer Bank/Payer PSP may also send the communication for issuance of the e-RUPI voucher to the end beneficiary via another mode basis on the Sponsor request (digital mode only).

- The validity of the e-RUPI voucher shall be defined by the Issuer Bank/Payer Payment Service Providers (PSP) as per the use case (Max validity per voucher – 1 year).

Participants in e-RUPI ecosystem

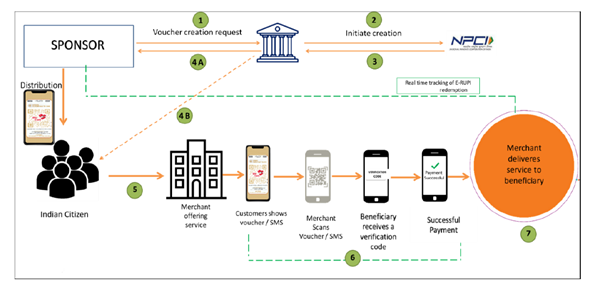

e-RUPI workflow

- Corporate/Government Department (Sponsor) shares information (specify the fields like name, mobile no, amount, expiry date, purpose of the voucher etc.) to issue e- RUPI to Issuer Bank.

- Issuer Bank/Payer PSP initiates the request to generate e-RUPI to NPCI.

- NPCI responds to Issuer Bank/Payer PSP with success confirmation.

- Issuer Bank/Payer PSP confirms e-RUPI generation back to Corporate / Government Entity, to be further distributed to the beneficiary in the form of QR or SMS string by the Bank/Sponsor.

- Beneficiary reaches merchant with e-RUPI redemption.

- Merchants scan e-RUPI vouchers for validation, verify beneficiaries, and initiate redemption requests.

- Post successful redemption confirmation, the merchant provides service to the beneficiary.

Key differences between UPI and e-Rupi/CBDC

The following are the compilation of key differences between UPI and e-Rupi as understood from various RBI discussions and opinions from Industry Leaders.

1. No Bank account required for e-Rupi

To carry out payments through UPI, one needs to have a bank account, UPI ID. But for accessing the e-Rupi wallet, there will be no need to have such a bank account. With a retail CBDC, people should be able to transact without any bank involved (like physical cash) and it’s a digital transfer from people to people direct minus a bank intermediary. It will have the same denominations as physical cash.

2. Anonymity can be maintained

Transactions in digital rupee may offer the same anonymity as cash transactions. The RBI has asked lenders not to report low-value transactions made through the digital rupee. Once the retail CBDC is transferred to customer wallets, banks will not track or report these transactions. Currently, most cash transactions over Rs 50,000 require customers to disclose their permanent account number. While no limit has been set for digital rupee transactions, it is believed that retail transactions up to Rs 50,000 will not be reported. Transactions in excess of Rs 2 lakh will have to be reported for tax purposes. Experts suggest that the move will ensure the virtual currency will offer a similar degree of anonymity associated with paper money for business exchanges below a value threshold.

3. No need for physical currency backup

UPI transactions are backed by physical currency. This means the payment will not go through if the user’s bank account does not have enough funds. The e-rupee, however, can be used for digital payments in lieu of currency/cash. It is a legal tender in itself and need not necessarily be backed by physical currency unlike the UPI.

4. Single handle for all

Depending upon the banks and platforms, the UPI handle or ID varies. Even linking two different platforms with the same bank account may generate different UPI ID, but such will not be the case for e-Rupi. The digital rupee will be operated by RBI and not by bank intermediaries like in the case of UPI where each bank has a different UPI handler. E-rupi will have a single public key (address).

5. Transaction without a smartphone

Yet another major benefit of using the e-rupee is that it will allow offline transactions which can be carried out on feature phones, promoting its adoption in rural and remote areas as well. Since the e-rupee voucher will be shared with the beneficiary through an SMS or QR code. This will enable its use in rural and remote areas as well where internet connectivity can be a problem. And if it is in the form of an SMS, anyone without a smartphone can utilize it as well.

e-RUPI Current Status

While this is under the initial phase, Dec 2022 definitely has seen some activities in this space. To begin with NPCI has tied up with more than 1,600 hospitals where e-RUPI can be redeemed currently. In the days to come the user base of e-RUPI is expected to widen, with even private sector using it to deliver employee benefits and MSMEs adopting it for Business to Business (B2B) transactions

e-RUPI Live Banks as of Dec 2022

| Bank Name | |||

|---|---|---|---|

| AU Small Finance Bank | |||

| Axis Bank | |||

| Bank of Baroda | Issuer | Acquirer | Acquiring App / Entity |

| Bank of India | ✔ | NA | |

| Bank of Maharashtra | ✔ | ✔ | BharatPe |

| Canara Bank | ✔ | ✔ | BHIM Baroda Merchant Pay |

| Central Bank of India | ✔ | NA | |

| Federal Bank | ✔ | NA | |

| HDFC Bank | ✔ | ✔ | Canara eRUPI Acquirer |

| ICICI Bank | ✔ | NA | |

| IndusInd Bank | ✔ | NA | |

| Indian Bank | ✔ | ✔ | HDFC Business App & Ezetap |

| Indian Overseas Bank | ✔ | ✔ | BharatPe and Pine Labs |

| Karnataka Bank | ✔ | NA | |

| Karur vysya Bank | ✔ | ✔ | IB Corporate Merchant |

| Kotak Bank | ✔ | NA | |

| Paytm Payment Banks | ✔ | NA | |

| Punjab National Bank | ✔ | NA | |

| State Bank of India | ✔ | NA | |

| UCO Bank | ✔ | Paytm Business App | |

| Union Bank of India | ✔ | ✔ | PNB Merchant Pay |

| Total | ✔ | ✔ | YONO SBI Merchant |

| ✔ | ✔ | BHIM UCO UPI | |

| ✔ | NA | ||

| 20 | 10 | 11 |

Partners Live on e-RUPI API Gateway Platform

| Sponsor Name | Live On API Gateway Platform |

|---|---|

| National Health Authority | Yes |

| Odisha Government | Yes |

| Tripura Government | Yes |

Latest Statistics of Transactions of e-RUPI for the month of Dec 2022.

| Use Case Name | Voucher Created Volume | Voucher Redeemed Volume |

|---|---|---|

| National Health Authority: AB-PMJAY | 27,566 | 2,964 |

| Madhya Pradesh Government: Agriculture Equipment Distribution | 62 | 37 |

| Haryana Government: Mobile Distribution | 19 | 4 |

| Tripura Government: Student Stipend | 2 | 0 |

| Madhya Pradesh Government: Cycle Distribution | 3 | 3 |

| Total | 27,652 | 3,008 |

Concluding Thoughts

While the above are merely indicative in nature, the actual reality could vary based on the progress, challenges and updates by RBI into the entire infrastructure or the system set up. It is to be noted that CBDC is aimed to complement, rather than replace, current forms of money and is envisaged to provide an additional payment avenue to users, not to replace the existing payment systems. In the days to come the user base of e-RUPI is expected to widen, with even private sector using it to deliver employee benefits and MSMEs adopting it for Business to Business (B2B) transactions. Only time will speak of its success story.

Reference:

This is an article compiled from the Concept Note on Central Bank Digital Currency hosted at the RBI website, NPCI and the various publicly available research articles.

Author

The author CA Narasimhan Elangovan, is a practising CA and partner KEN & Co. He is a GRC Professional, a Digital transformation catalyst and an author. He believes in the power of technology to solve everyday problems. He can be reached at narasimhan@ken-co.in